Superior utility unlocks unprecedented capital efficiency.

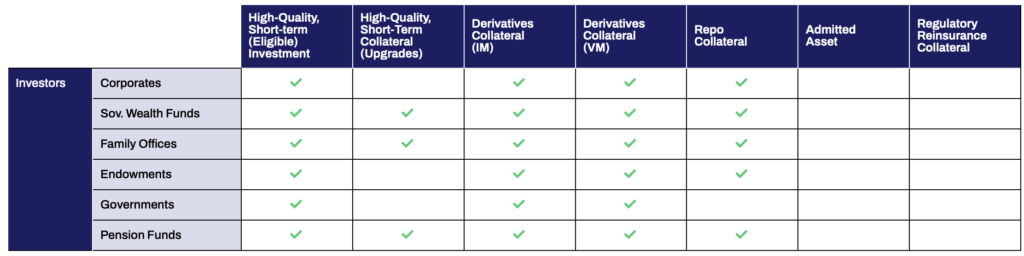

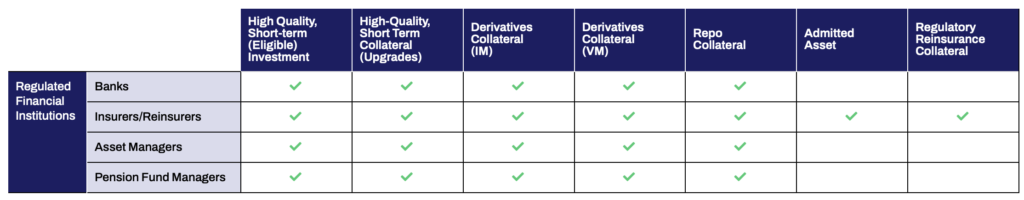

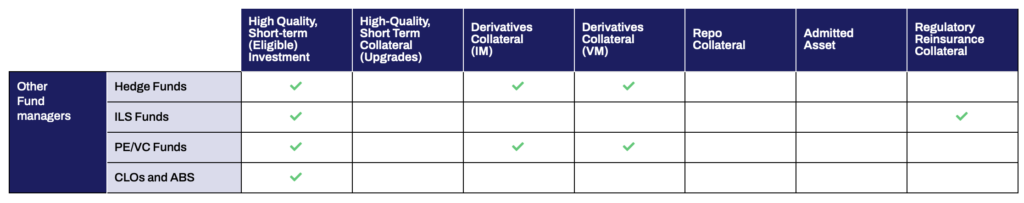

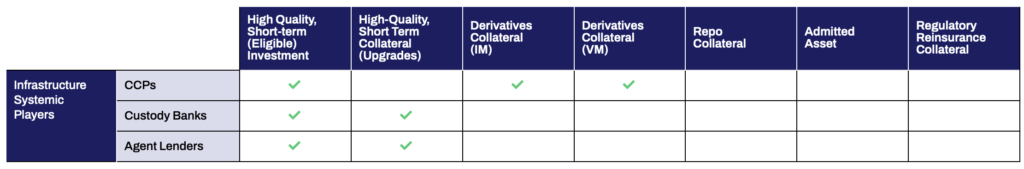

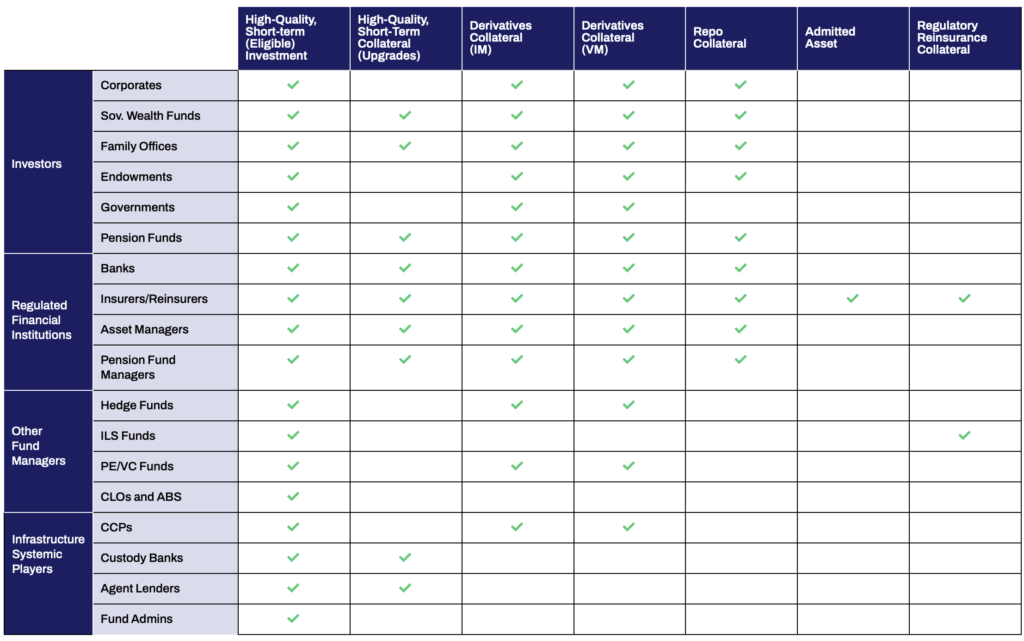

Think of RISCMTP-Notes as a cash investment with a double life. RISCMTP-Notes can be used where cash or T-Bills are accepted but without the management headache of unpredictable returns or investing in and maintaining infrastructure. The Notes’ versatility and nimbleness are due to their high quality and liquidity features, which make them eligible as collateral across a wide range of institutional and regulatory collateral applications.