What are RISCMTP-Notes?

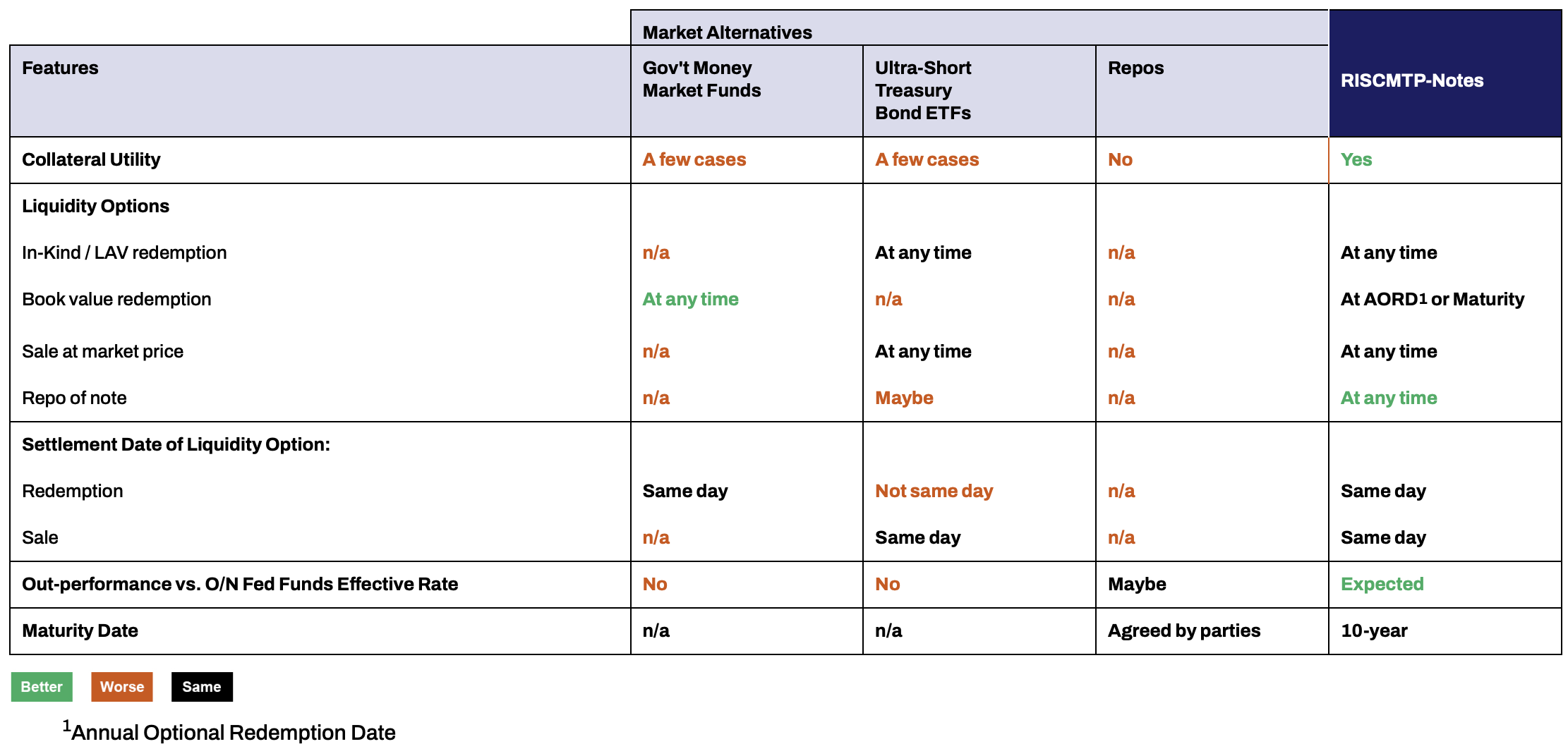

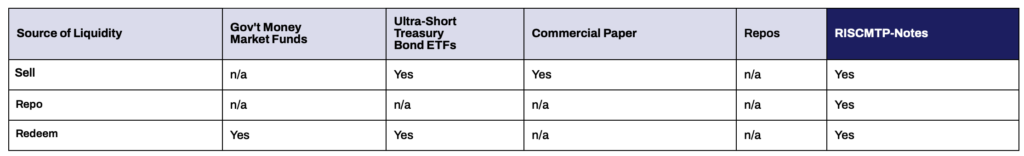

RISCMTP-Notes are a new unique debt security combining the liquidity of cash with the quality and managed returns of government money market funds. What’s more, RISCMTP-Notes are designed to serve as versatile collateral instruments that are designed to be more liquid, capital-efficient and secure than short-term credit securities (e.g., commercial paper and CDs), prime money market funds and ETFs. In short, your money works harder with RISCMTP-Notes.

What are the advantages of RISCMTP-Notes?

What are the advantages of RISCMTP-Notes?

Compared to money market funds

RISCMTP-Notes employ many government-money-market-mutual-fund management techniques to replicate money market returns inside a listed, rated fixed-income security that enables the Noteholder to exit at any time for current “Liquidated Asset Value” (LAV), without gating or penalties or at Book Value at each Annual Optional Redemption Date.

Compared to Treasury Bills

RISCMTP-Notes are the closest thing to owning Treasury Bills without having to choose or manage them yourself.

Compared to cash

RISCMTP-Notes are like cash with an imbedded managed return. Cash begs the questions: What can I buy? What will I earn? Am I capital-efficient? RISCMTP-Notes are the answer.

Compared to ETFs

RISCMTP-Notes are redeemable at any time under the Noteholder Optional Redemption right for the Noteholder’s share of the underlying securities (i.e., an In-Kind redemption) or their LAV (i.e., a cash redemption). They are also redeemable annually at Book Value on the Annual Optional Redemption Date. They are like zero risk-weighted ETFs without all the market risk.

No additives, derivatives or synthetics, just a simple, straightforward participation in the underlying note portfolio securities.

- Are provisionally rated (P)Aaa(sf) by Moody’s (see press release).

- Redeemable at any time, for same-day settlement, on an In-Kind or LAV basis.

- Expected to compete with O/N Fed Funds Effective Rate, 3- to 6- month U.S.Treasuries and government money market funds.

- Freely transferable in accordance with applicable securities laws.

- Versatile collateral instrument designed to be acceptable for:

- derivatives collateral (initial margin under Dodd-Frank and EMIR rules)

- repos and securities lending transactions

- central bank and bilateral secured borrowing transactions

- collateralised reinsurance transactions

- regulatory surplus/solvency relief transactions (in the U.S., U.K., Canada and Europe)

- Portable: more acceptable as collateral than a mutual fund share or similar fund investment .

- Attractive managed returns with a daily value on Bloomberg

- The Notes’ superior utility should allow them to trade at a premium to their Book Value, resulting in pay-as-you-go utility.

- Having the Utility Premium (UP) imbedded in the Notes enhances their collateral value (by the amount of the unamortised UP), reducing the need to over-collateralise security requirements and adding yet another utility feature.

Note: These represent RISCfp opinions. For actual application, you will need to consult with the receiving party for confirmation of acceptability.

RISCMTP-Notes Product Summary

If you would like to be notified when the full set of detailed documentation for RISCMTP-Notes becomes available, please register your interest and we will email you in due course.

If you would like to be notified when the full set of detailed documentation for RISCMTP-Notes becomes available, please register your interest and we will email you in due course.